Blog

Trend Report

Why South Africans Turn to Solar: Escaping Power Cuts and Rising Electricity Prices

Matthieu Danielou

Co-founder

Aug 22, 2025

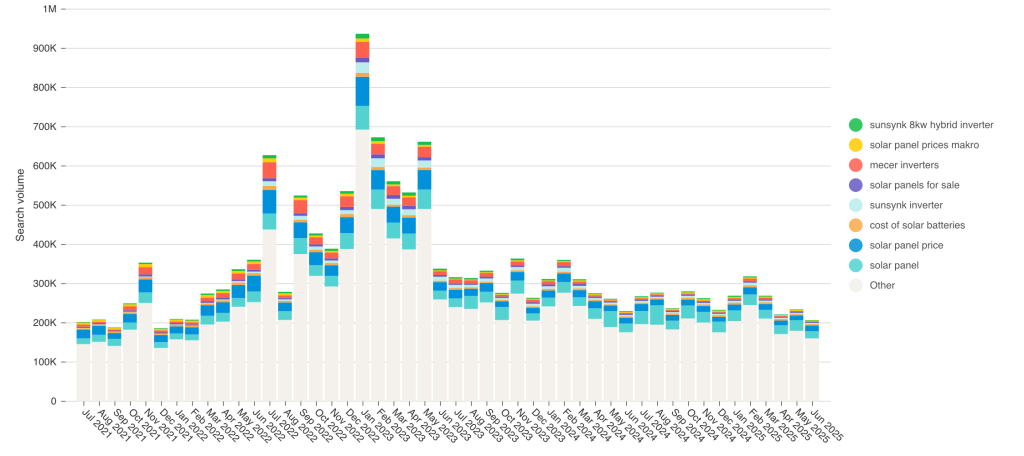

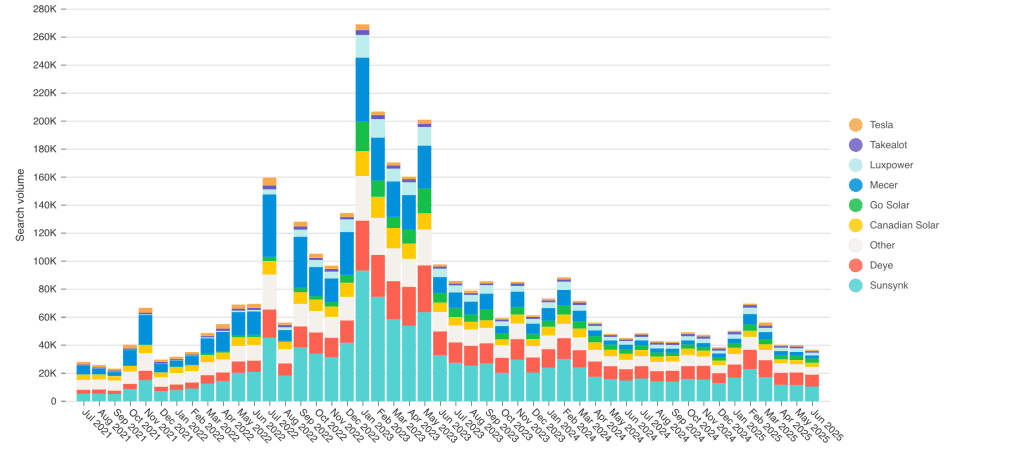

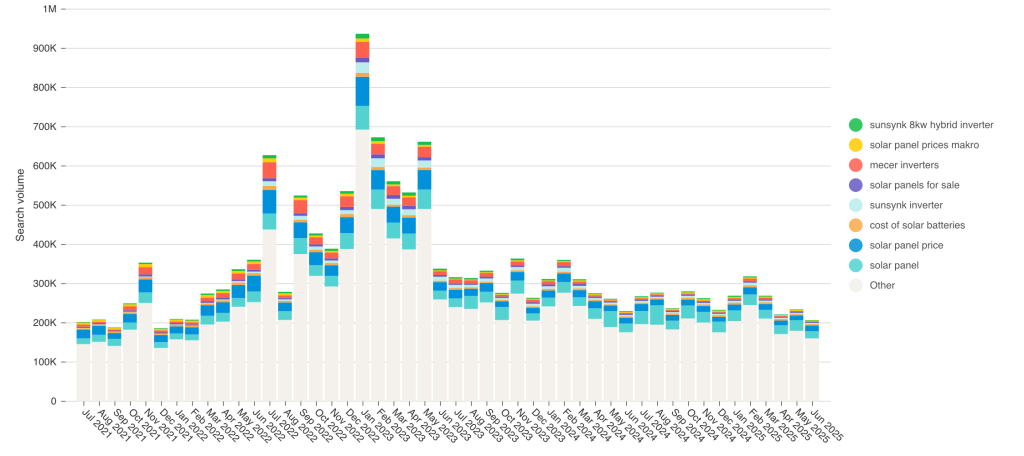

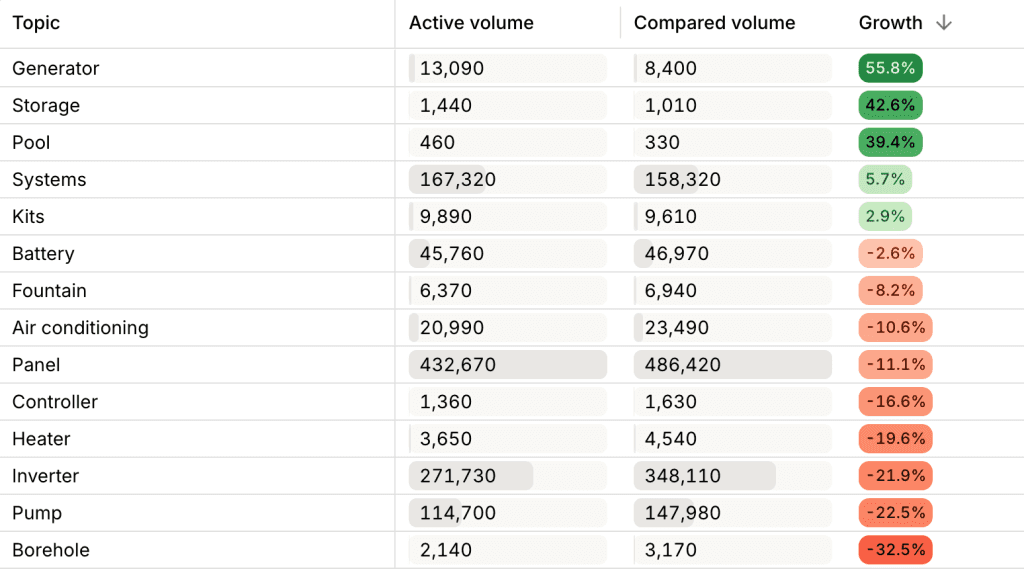

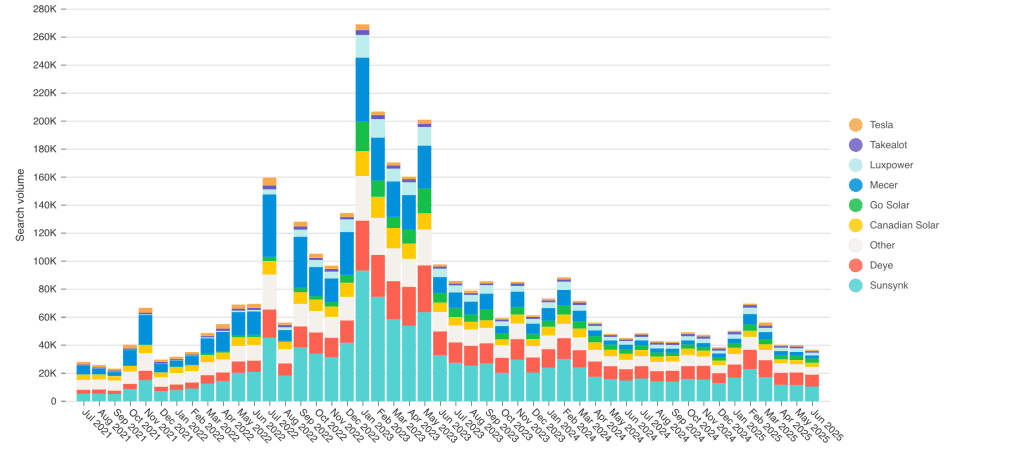

South Africa’s solar energy market is accelerating, fueled by rising electricity costs, frequent load shedding, and growing household and corporate demand for energy independence. Search data over the last 48 months reveals clear surges in interest for solar panels, pricing transparency, and battery storage, with brands like Mecer, Sunsynk, Deye, and Luxpower leading the way.

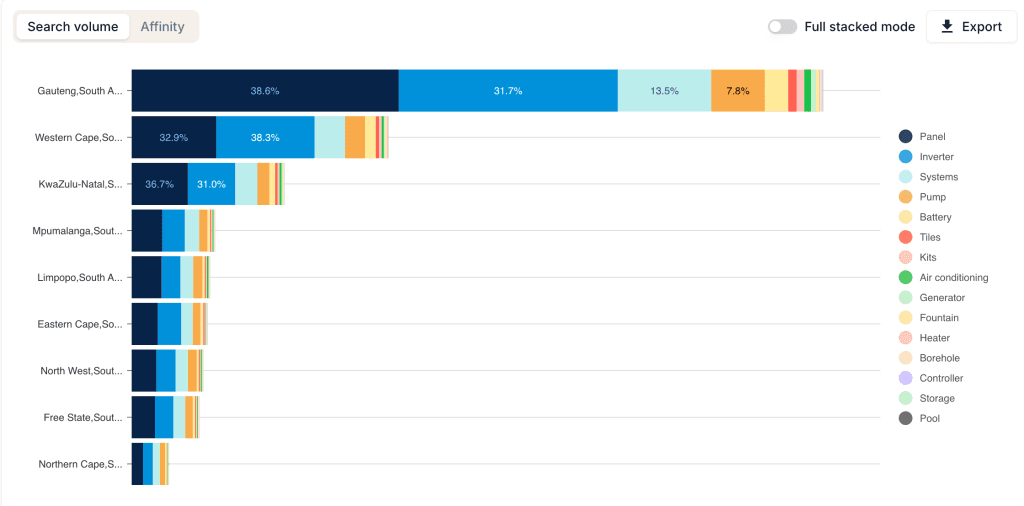

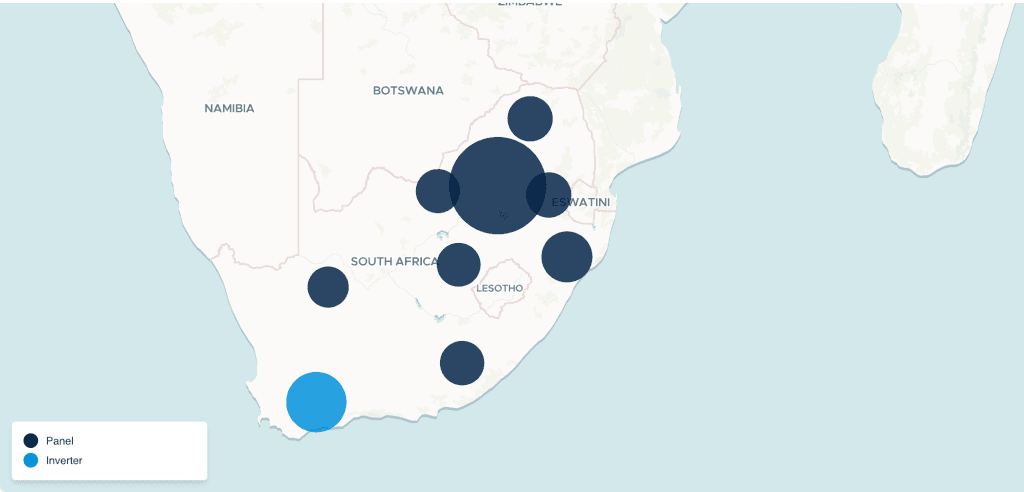

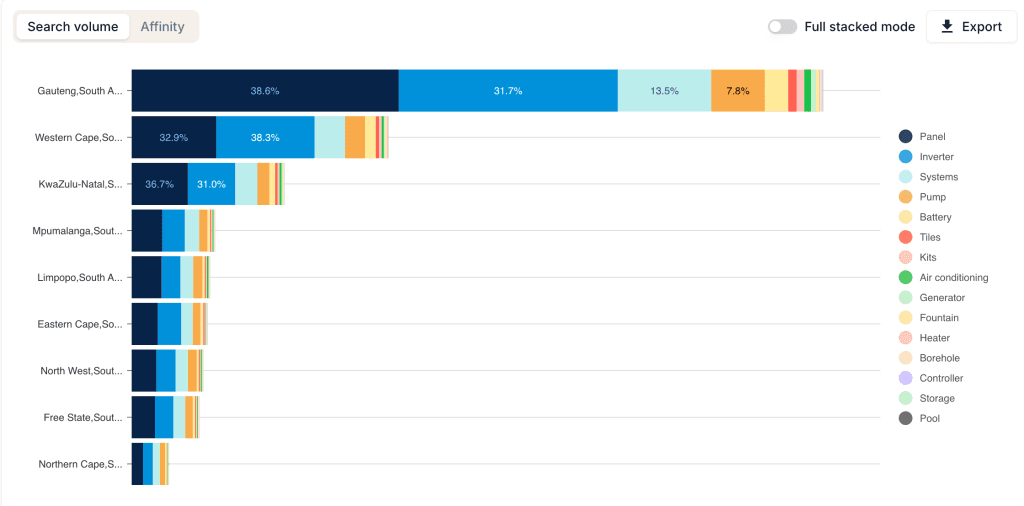

Regional patterns highlight Gauteng as the dominant hub of solar-related searches, but smaller provinces like Limpopo and Mpumalanga also display higher-than-expected interest relative to population size, suggesting latent demand and market opportunity.

Emerging weak signals point toward niche solar-powered appliances (fans, pumps, borewell systems), which—although low in current volume—reflect consumer experimentation with solar beyond traditional rooftop panels.

For brands, the winning formula will involve price transparency, localized solutions, and expanded product ecosystems.

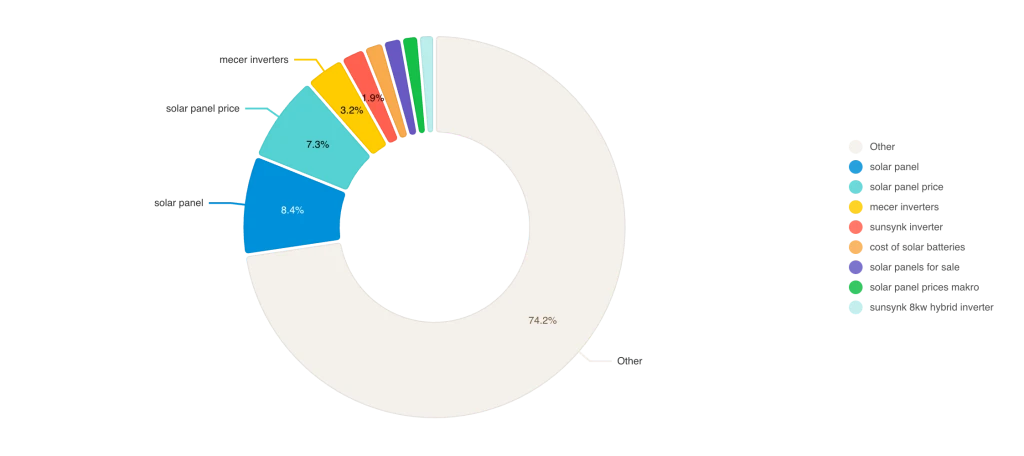

Search Trends: Price and Hardware Dominate Consumer Interest

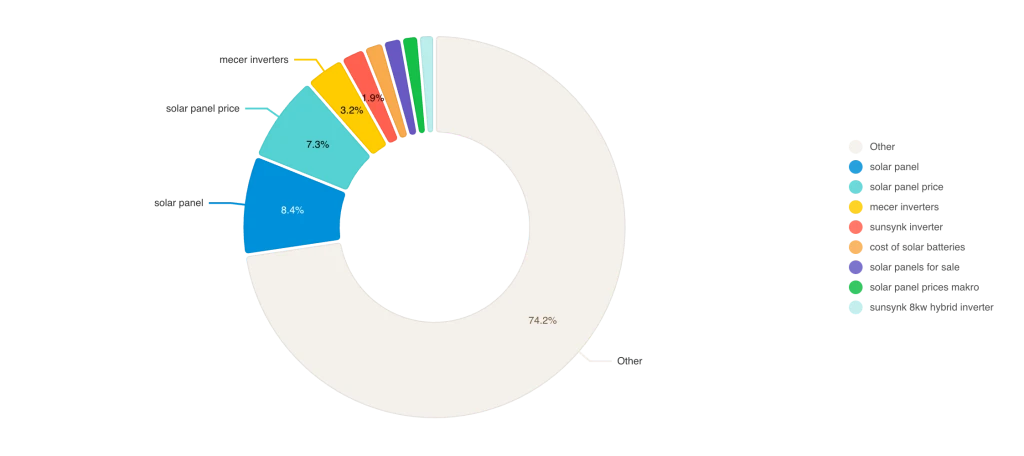

Recent search trends (last six months) indicate that South Africans are primarily focused on:

Solar panels (avg. 24K monthly searches) – the undisputed top query.

Solar panel price (14K) – reflecting consumer sensitivity to affordability.

Cost of solar batteries (4.5K) – indicating growing recognition that storage is critical to reliable solar adoption.

Sunsynk and Mecer inverters (3–4K) – pointing to brand-led searches and hardware-specific demand.

Solar panels for sale and solar air conditioning (~2.7K each) – suggesting a shift toward practical, product-oriented buying intent.

Insight: South Africans are moving beyond general curiosity toward purchase-driven queries, especially around prices and branded hardware.

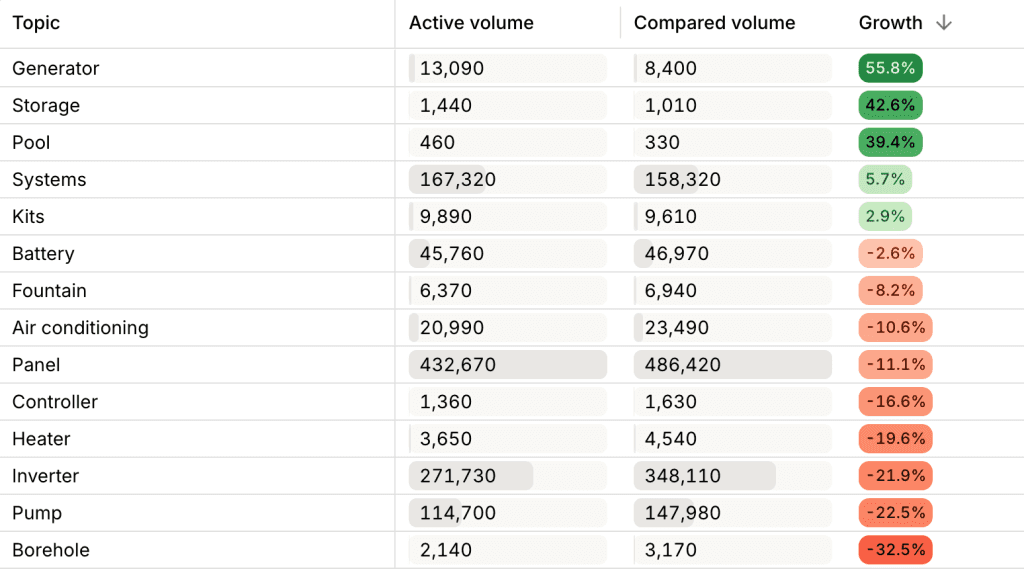

Emerging Niches: Solar Appliances Show Weak but Rising Signals

While the mainstream interest is clear, low-volume queries in the dataset provide a glimpse of future niches:

Solar-powered fans and mini-ventilation systems

Solar borehole and agricultural pumps

DIY solar systems and micro-projects

Although these topics have minimal volumes today, they represent nascent consumer experimentation. Given South Africa’s climate and rural population, solar irrigation and cooling could rapidly evolve from “weak signals” to mainstream demand segments.

Insight: Brands that experiment early in solar-agriculture and solar-appliance ecosystems could capture first-mover advantage.

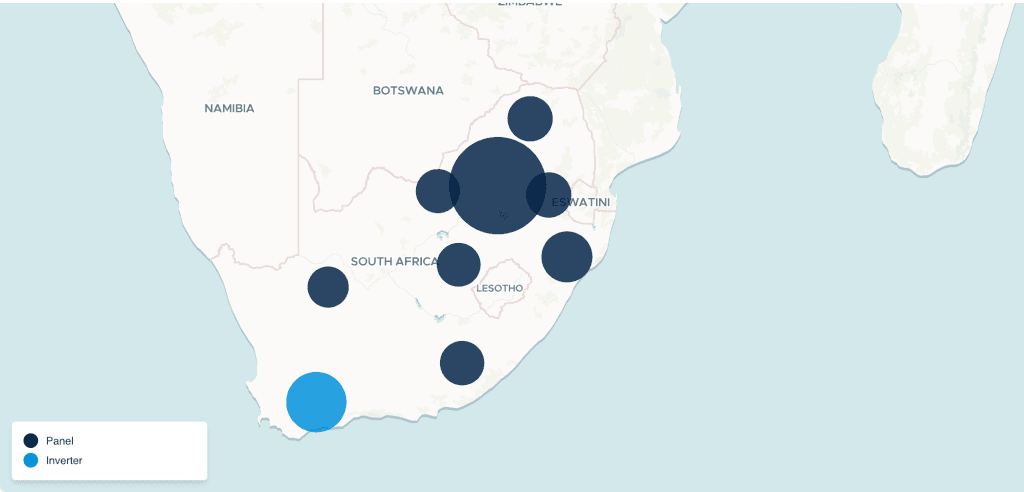

Regional Behavior: Gauteng Leads but Rural Provinces Overperform

Local affinity analysis highlights both expected and surprising results:

Gauteng dominates (8M weighted volume), as the economic hub with dense urban demand.

Western Cape & KwaZulu-Natal (2.9M & 1.7M) also show strong traction, linked to middle-class homeowners and tourism infrastructure.

Mpumalanga & Limpopo show disproportionately high per-capita search intensity compared to population size. These rural provinces face weaker grid reliability, making solar adoption a necessity rather than a luxury.

Insight: While Gauteng remains the largest market, Mpumalanga and Limpopo are strategic growth frontiers, ideal for regionalized marketing and lower-cost solutions.

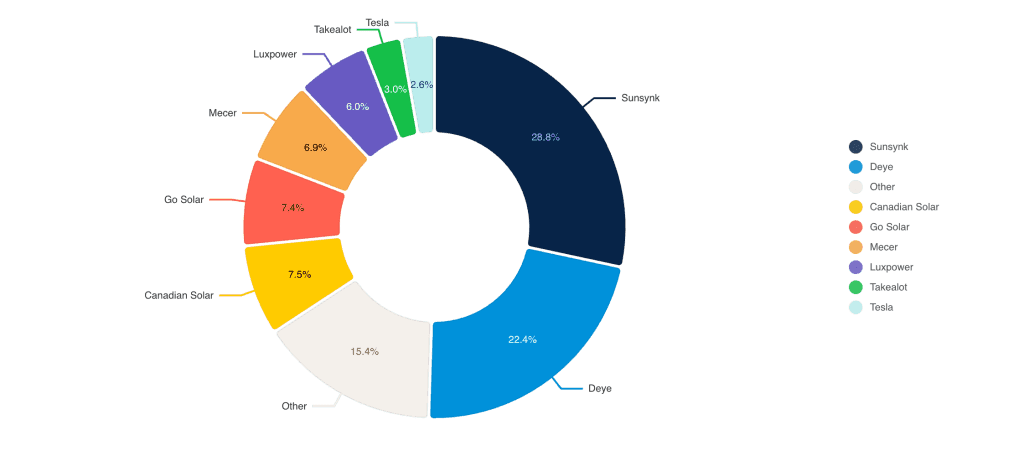

Brand Competition: Inverter Makers Define Market Dynamics

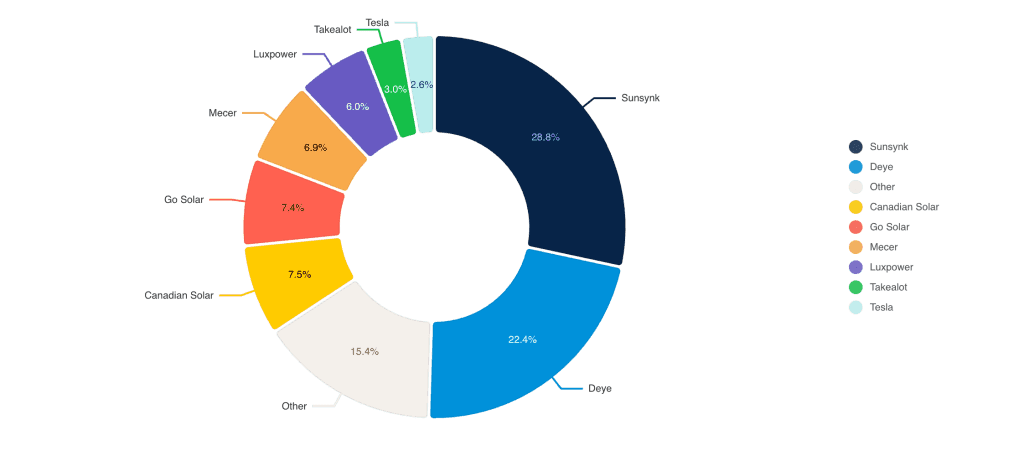

Brand-related searches reveal a competitive landscape:

Mecer inverters (500K searches) lead the pack, suggesting brand recognition built on affordability and distribution.

Sunsynk (295K, plus 180K for its 8kW hybrid inverter) is a rising challenger, positioned as a premium, hybrid solution provider.

Luxpower (166K) and Deye (154K) represent the next tier, steadily gaining traction.

Battery-specific queries (e.g., Sunsynk battery) also highlight consumer interest in integrated systems.

Insight: The inverter battle is defining the competitive landscape. Brands that bundle panels + batteries + smart inverters will capture more market share than hardware-only players.

How Brands Can Capture Market Leadership

Based on the insights, here’s the strategic playbook for brands aspiring to dominate South Africa’s solar market:

Win on Transparency:

Consumers search heavily for “solar panel price” and “cost of batteries.”

Clear, upfront pricing and ROI calculators will boost trust.

Expand Beyond Panels:

Target solar batteries, inverters, and hybrid solutions.

Offer modular systems adaptable to household budgets.

Regionalize Offerings:

Gauteng: emphasize premium, reliable, smart systems.

Limpopo & Mpumalanga: promote affordable, durable, and agriculture-oriented products.

Leverage Weak Signals:

Pilot solar fans, irrigation pumps, and borewell kits.

These niches could unlock rural adoption and create ecosystem stickiness.

Build Brand Strength:

Position as an integrated ecosystem provider (panels + batteries + services).

Highlight reliability during load-shedding seasons to anchor trust.

Bottom line: The next market leader will not simply sell solar panels—it will deliver affordable, localized, ecosystem-based solar independence.

South Africa’s solar energy market is accelerating, fueled by rising electricity costs, frequent load shedding, and growing household and corporate demand for energy independence. Search data over the last 48 months reveals clear surges in interest for solar panels, pricing transparency, and battery storage, with brands like Mecer, Sunsynk, Deye, and Luxpower leading the way.

Regional patterns highlight Gauteng as the dominant hub of solar-related searches, but smaller provinces like Limpopo and Mpumalanga also display higher-than-expected interest relative to population size, suggesting latent demand and market opportunity.

Emerging weak signals point toward niche solar-powered appliances (fans, pumps, borewell systems), which—although low in current volume—reflect consumer experimentation with solar beyond traditional rooftop panels.

For brands, the winning formula will involve price transparency, localized solutions, and expanded product ecosystems.

Search Trends: Price and Hardware Dominate Consumer Interest

Recent search trends (last six months) indicate that South Africans are primarily focused on:

Solar panels (avg. 24K monthly searches) – the undisputed top query.

Solar panel price (14K) – reflecting consumer sensitivity to affordability.

Cost of solar batteries (4.5K) – indicating growing recognition that storage is critical to reliable solar adoption.

Sunsynk and Mecer inverters (3–4K) – pointing to brand-led searches and hardware-specific demand.

Solar panels for sale and solar air conditioning (~2.7K each) – suggesting a shift toward practical, product-oriented buying intent.

Insight: South Africans are moving beyond general curiosity toward purchase-driven queries, especially around prices and branded hardware.

Emerging Niches: Solar Appliances Show Weak but Rising Signals

While the mainstream interest is clear, low-volume queries in the dataset provide a glimpse of future niches:

Solar-powered fans and mini-ventilation systems

Solar borehole and agricultural pumps

DIY solar systems and micro-projects

Although these topics have minimal volumes today, they represent nascent consumer experimentation. Given South Africa’s climate and rural population, solar irrigation and cooling could rapidly evolve from “weak signals” to mainstream demand segments.

Insight: Brands that experiment early in solar-agriculture and solar-appliance ecosystems could capture first-mover advantage.

Regional Behavior: Gauteng Leads but Rural Provinces Overperform

Local affinity analysis highlights both expected and surprising results:

Gauteng dominates (8M weighted volume), as the economic hub with dense urban demand.

Western Cape & KwaZulu-Natal (2.9M & 1.7M) also show strong traction, linked to middle-class homeowners and tourism infrastructure.

Mpumalanga & Limpopo show disproportionately high per-capita search intensity compared to population size. These rural provinces face weaker grid reliability, making solar adoption a necessity rather than a luxury.

Insight: While Gauteng remains the largest market, Mpumalanga and Limpopo are strategic growth frontiers, ideal for regionalized marketing and lower-cost solutions.

Brand Competition: Inverter Makers Define Market Dynamics

Brand-related searches reveal a competitive landscape:

Mecer inverters (500K searches) lead the pack, suggesting brand recognition built on affordability and distribution.

Sunsynk (295K, plus 180K for its 8kW hybrid inverter) is a rising challenger, positioned as a premium, hybrid solution provider.

Luxpower (166K) and Deye (154K) represent the next tier, steadily gaining traction.

Battery-specific queries (e.g., Sunsynk battery) also highlight consumer interest in integrated systems.

Insight: The inverter battle is defining the competitive landscape. Brands that bundle panels + batteries + smart inverters will capture more market share than hardware-only players.

How Brands Can Capture Market Leadership

Based on the insights, here’s the strategic playbook for brands aspiring to dominate South Africa’s solar market:

Win on Transparency:

Consumers search heavily for “solar panel price” and “cost of batteries.”

Clear, upfront pricing and ROI calculators will boost trust.

Expand Beyond Panels:

Target solar batteries, inverters, and hybrid solutions.

Offer modular systems adaptable to household budgets.

Regionalize Offerings:

Gauteng: emphasize premium, reliable, smart systems.

Limpopo & Mpumalanga: promote affordable, durable, and agriculture-oriented products.

Leverage Weak Signals:

Pilot solar fans, irrigation pumps, and borewell kits.

These niches could unlock rural adoption and create ecosystem stickiness.

Build Brand Strength:

Position as an integrated ecosystem provider (panels + batteries + services).

Highlight reliability during load-shedding seasons to anchor trust.

Bottom line: The next market leader will not simply sell solar panels—it will deliver affordable, localized, ecosystem-based solar independence.

Matthieu Danielou

Co-founder

Share