Blog

Trend Report

The Skyward Shift: Mapping the Rise and Fall of Flight Search Trends in Singapore

Matthieu Danielou

Co-founder

May 22, 2025

Navigating Complexity in the Travel Marketing Landscape

For travel marketers, one of the biggest challenges in 2025 is keeping pace with shifting consumer desires in a post-pandemic, digitally saturated world. The traditional travel funnel is gone; consumers today explore, compare, and decide in non-linear journeys. And with the explosion of online travel agencies, airline promos, and digital content, discerning genuine demand is harder than ever. But one signal remains raw and revealing: what people search for.

At Trajaan, we believe that search intent is one of the most powerful indicators of consumer interest. In this article, we dive deep into flight-related search data from Singapore to understand what destinations are surging, how preferences are evolving, and where geo-localized outliers offer untapped marketing opportunities.

1. Overview of the Analyzed Keywords

Our dataset encompasses 10000+ flight-related keywords, including queries such as:

"cheap flights to London"

"flight ticket to Bangkok"

"book flight to Penang"

"flights to Bali"

"flight ticket to Seoul"

All these search queries are aggregated by destination and related topics ("cheap", "best"...).

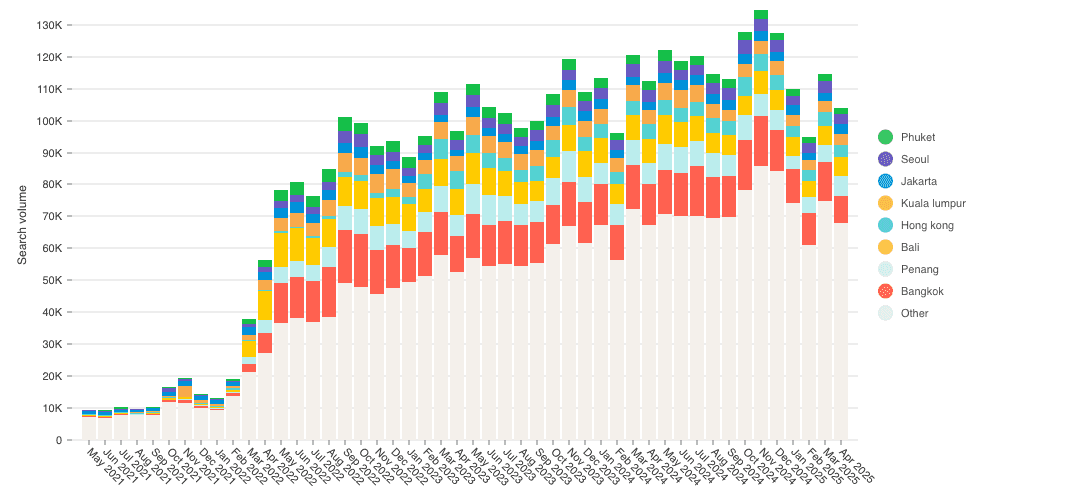

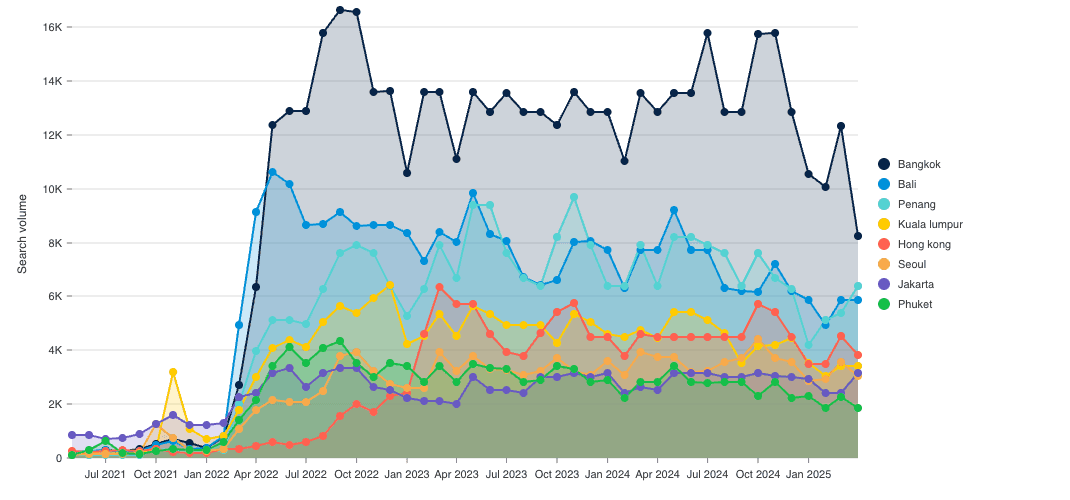

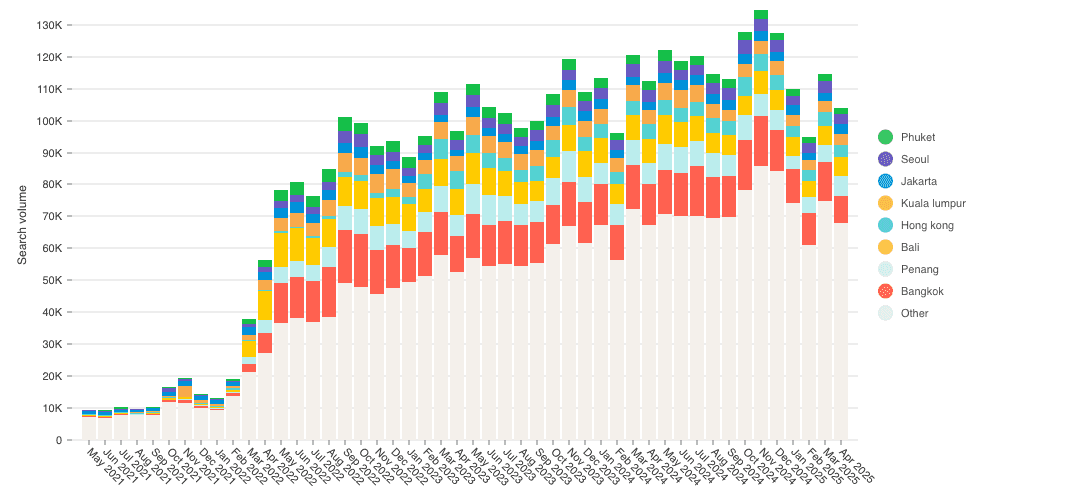

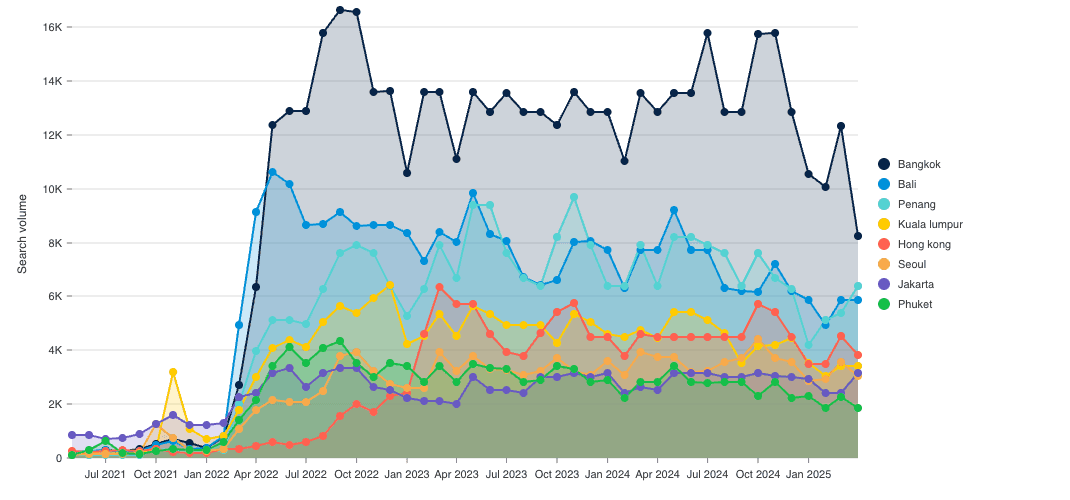

We tracked these keywords across time (monthly volume from May 2021 to April 2025) and space (based on location data from 29 sub-regions in Singapore like Bedok, Tampines, and Jurong West). The volume of each query is an excellent proxy for consumer interest and planning intent.

2. Trend Detection: What’s Hot and What’s Cooling

To reveal recent changes, we focused on search data from the last five months: December 2024 to April 2025.

Top 10 Destinations by Search Volume:

Bangkok

Penang

Bali

Hong Kong

Jakarta

Seoul

Taipei

Kuala Lumpur

Osaka

Ho Chi Minh City

These cities dominate for good reason. Bangkok and Penang lead the pack, driven by regional travel demand and accessibility. Their spike aligns with school holiday periods and long weekends, which likely fueled search growth.

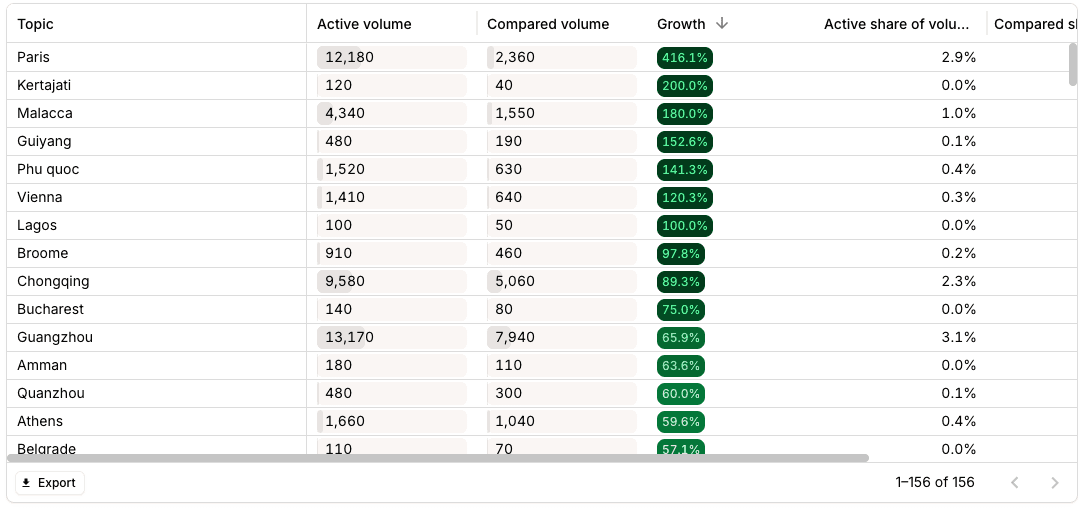

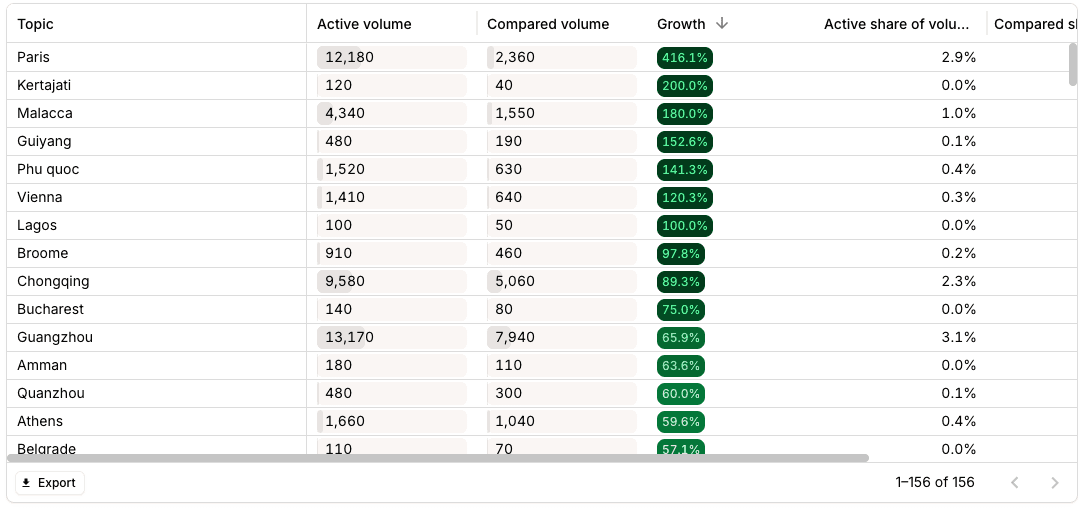

Paris is Booming (+416%)

Paris leads the pack with a staggering 416% increase in search volume—suggesting a major resurgence in long-haul European interest, possibly due to the past Olympic Games, seasonal promotions, or relaxed visa/travel restrictions.

Hidden Regional Gems Are Trending

Destinations like Kertajati (+200%), Malacca (+180%), and Guiyang (+152.6%) show dramatic growth despite modest absolute volumes. This may reflect rising curiosity in secondary cities or new flight routes launched recently.

Southeast Asia Stays Strong

Places like Phu Quoc and Malacca highlight continued appetite for regional travel—especially islands and cultural heritage destinations that offer shorter, more affordable getaways from Singapore.

China is Recovering—but Unevenly

Cities like Chongqing (+89.3%) and Guangzhou (+65.9%) indicate a gradual return of interest in China-bound travel, though the recovery is slower compared to other destinations like Paris or Vienna.

European Cities Are Catching Up

Vienna, Bucharest, and Athens are all showing double-digit to triple-digit growth, reflecting a wider comeback of European travel in 2025. These gains suggest a potential return of high-value, long-haul vacation planning.

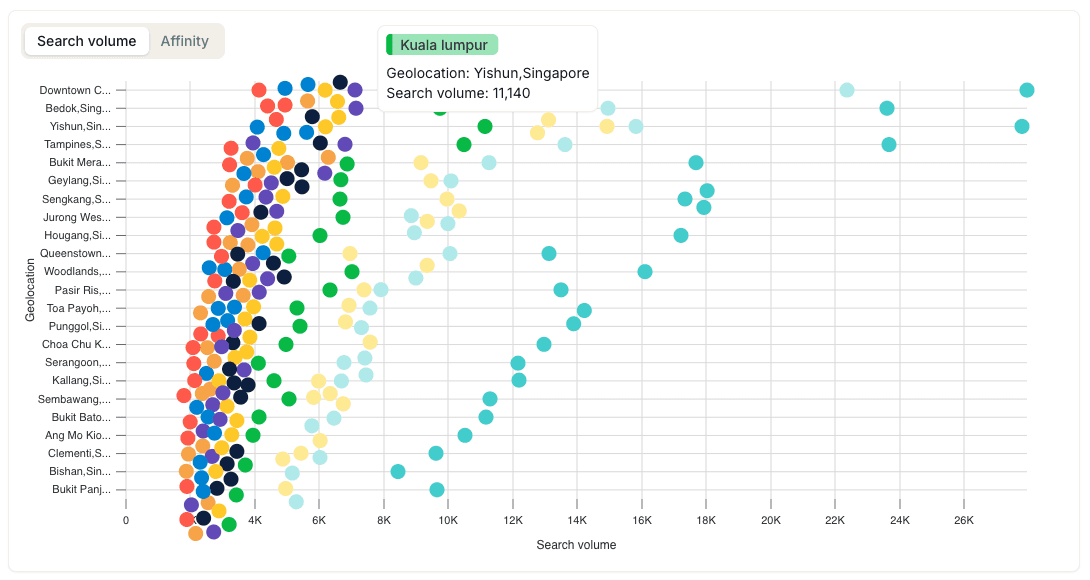

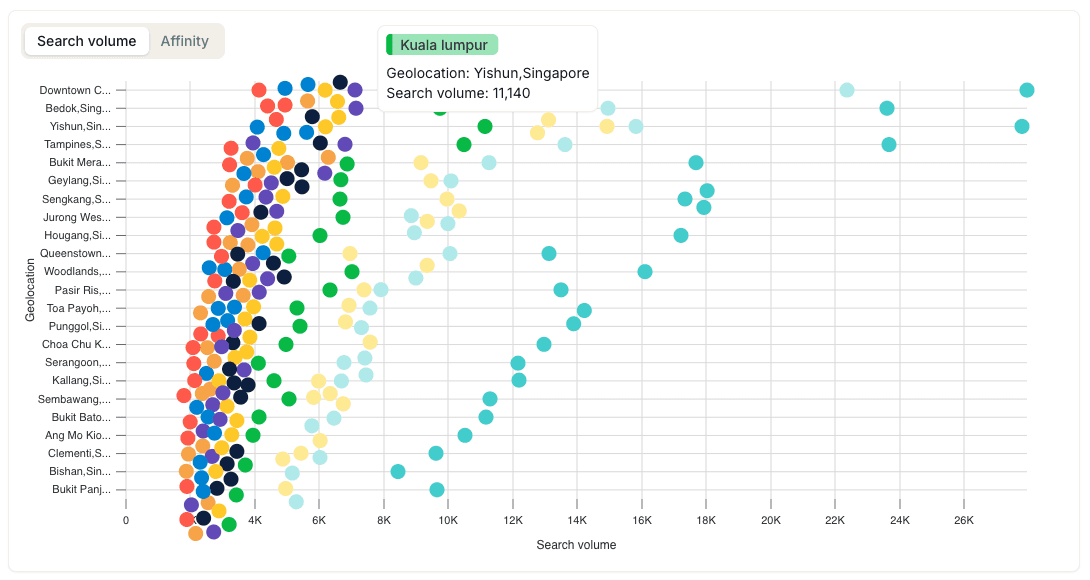

3. Geo-Based Trend Analysis: Where Demand Gets Local

The richness of this data lies not only in volume but in geographic contrast. By analyzing search volume per keyword across Singapore’s districts, we uncover strong local preferences.

Key Local Outliers:

Sengkang shows high interest in Chongqing and Dhaka—a signal possibly tied to ethnic communities or diaspora groups.

Bedok ranks among the top districts for Bali, Penang, and Bangkok—ideal for targeting short-trip promo campaigns.

Jurong West leans toward Hong Kong and Jakarta, suggesting demand from working-class or SME-linked travelers.

Why does this matter? Because travel marketers waste money when they treat Singapore as a monolith. Trajaan’s neighborhood-level data enables marketers to match destinations with local psychographics, boosting campaign relevance and performance.

Predicting Demand, Not Reacting to It

Flight search data doesn’t lie. When someone searches for a ticket to Osaka, they’re not browsing—they’re planning. In a crowded marketing environment, acting on these early signals is your advantage.

Trajaan empowers travel brands, airlines, and agencies to unlock these insights with precision. You don’t need to wait for bookings to know what people want—you can see it in search. And in today’s landscape, that’s the edge that defines market leaders.

Ready to discover how consumer demand is shifting in real time? Let Trajaan show you what your future travelers are already searching for.

Navigating Complexity in the Travel Marketing Landscape

For travel marketers, one of the biggest challenges in 2025 is keeping pace with shifting consumer desires in a post-pandemic, digitally saturated world. The traditional travel funnel is gone; consumers today explore, compare, and decide in non-linear journeys. And with the explosion of online travel agencies, airline promos, and digital content, discerning genuine demand is harder than ever. But one signal remains raw and revealing: what people search for.

At Trajaan, we believe that search intent is one of the most powerful indicators of consumer interest. In this article, we dive deep into flight-related search data from Singapore to understand what destinations are surging, how preferences are evolving, and where geo-localized outliers offer untapped marketing opportunities.

1. Overview of the Analyzed Keywords

Our dataset encompasses 10000+ flight-related keywords, including queries such as:

"cheap flights to London"

"flight ticket to Bangkok"

"book flight to Penang"

"flights to Bali"

"flight ticket to Seoul"

All these search queries are aggregated by destination and related topics ("cheap", "best"...).

We tracked these keywords across time (monthly volume from May 2021 to April 2025) and space (based on location data from 29 sub-regions in Singapore like Bedok, Tampines, and Jurong West). The volume of each query is an excellent proxy for consumer interest and planning intent.

2. Trend Detection: What’s Hot and What’s Cooling

To reveal recent changes, we focused on search data from the last five months: December 2024 to April 2025.

Top 10 Destinations by Search Volume:

Bangkok

Penang

Bali

Hong Kong

Jakarta

Seoul

Taipei

Kuala Lumpur

Osaka

Ho Chi Minh City

These cities dominate for good reason. Bangkok and Penang lead the pack, driven by regional travel demand and accessibility. Their spike aligns with school holiday periods and long weekends, which likely fueled search growth.

Paris is Booming (+416%)

Paris leads the pack with a staggering 416% increase in search volume—suggesting a major resurgence in long-haul European interest, possibly due to the past Olympic Games, seasonal promotions, or relaxed visa/travel restrictions.

Hidden Regional Gems Are Trending

Destinations like Kertajati (+200%), Malacca (+180%), and Guiyang (+152.6%) show dramatic growth despite modest absolute volumes. This may reflect rising curiosity in secondary cities or new flight routes launched recently.

Southeast Asia Stays Strong

Places like Phu Quoc and Malacca highlight continued appetite for regional travel—especially islands and cultural heritage destinations that offer shorter, more affordable getaways from Singapore.

China is Recovering—but Unevenly

Cities like Chongqing (+89.3%) and Guangzhou (+65.9%) indicate a gradual return of interest in China-bound travel, though the recovery is slower compared to other destinations like Paris or Vienna.

European Cities Are Catching Up

Vienna, Bucharest, and Athens are all showing double-digit to triple-digit growth, reflecting a wider comeback of European travel in 2025. These gains suggest a potential return of high-value, long-haul vacation planning.

3. Geo-Based Trend Analysis: Where Demand Gets Local

The richness of this data lies not only in volume but in geographic contrast. By analyzing search volume per keyword across Singapore’s districts, we uncover strong local preferences.

Key Local Outliers:

Sengkang shows high interest in Chongqing and Dhaka—a signal possibly tied to ethnic communities or diaspora groups.

Bedok ranks among the top districts for Bali, Penang, and Bangkok—ideal for targeting short-trip promo campaigns.

Jurong West leans toward Hong Kong and Jakarta, suggesting demand from working-class or SME-linked travelers.

Why does this matter? Because travel marketers waste money when they treat Singapore as a monolith. Trajaan’s neighborhood-level data enables marketers to match destinations with local psychographics, boosting campaign relevance and performance.

Predicting Demand, Not Reacting to It

Flight search data doesn’t lie. When someone searches for a ticket to Osaka, they’re not browsing—they’re planning. In a crowded marketing environment, acting on these early signals is your advantage.

Trajaan empowers travel brands, airlines, and agencies to unlock these insights with precision. You don’t need to wait for bookings to know what people want—you can see it in search. And in today’s landscape, that’s the edge that defines market leaders.

Ready to discover how consumer demand is shifting in real time? Let Trajaan show you what your future travelers are already searching for.

Matthieu Danielou

Co-founder

Share