Blog

Trend Report

How to Win Share of Intent in Australian Retail Banking Search Today

Matthieu Danielou

Co-founder

Sep 3, 2025

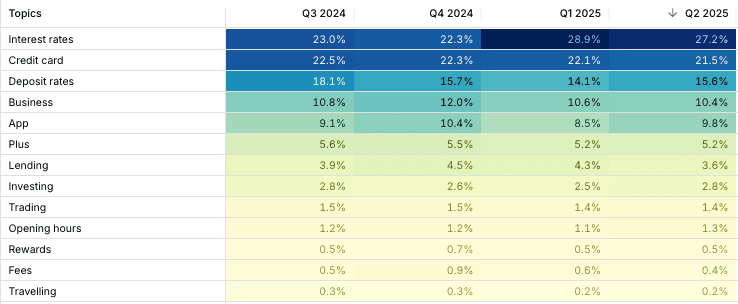

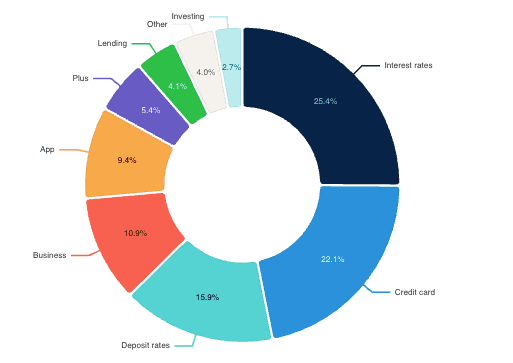

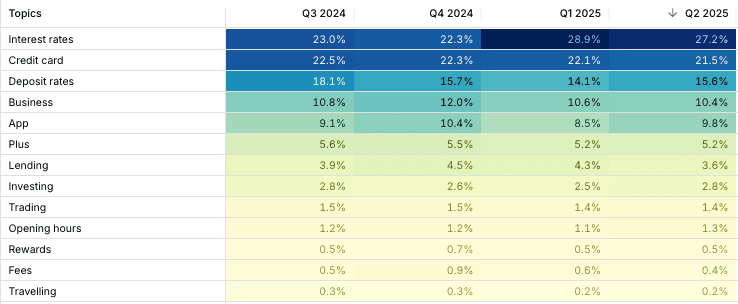

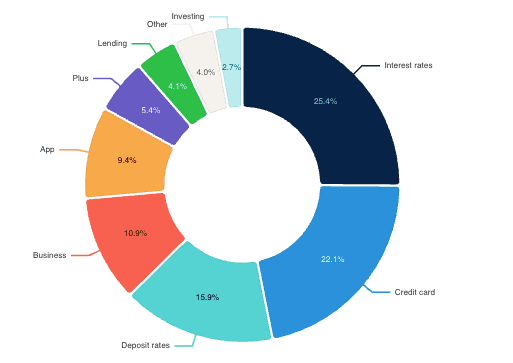

Australian banking searches cluster around interest rates, credit cards, deposit rates, and business banking, with app intent and investing emerging as the only clear growth areas while overall rate chatter cools.

To win in this landscape, banks should:

Guide users with beginner-friendly investing paths and weekly share tracking.

Perfect app landing experiences.

Offer sharper credit card comparisons.

Deliver localized content that reflects state-level needs.

Maintain live rate hubs for real-time engagement.

Early Market Signals and How to Respond: Apps and Cards Up, Investing Rebounding, Rate Interest Easing

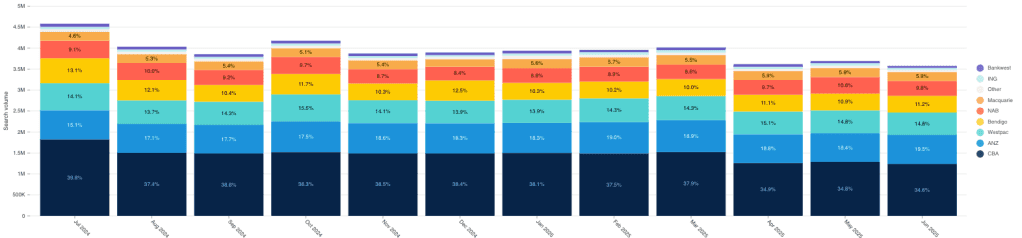

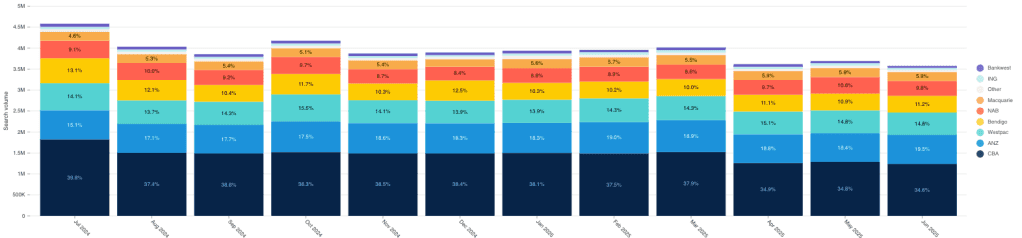

App resilience is real: after an early-2025 dip, app intent rebounded to 9.8% with rising 3-month momentum. Push app performance, money tools, and login reliability to capture new demand.

Investing bounce has started: investing searches jumped 24% in June (2.7% share). States with high appetite are ready for education and easy entry products.

Credit cards outperformed: share rose 3 pts in June with strong brand demand. Use refreshed offers and reward copy to convert interest. Quarterly share slipped slightly to 21.5% in Q2 (vs 22.1% in Q1, 22.3% in Q4 2024).

Interest Rate increase is visible: peaked at 28.9% in Q1 2025, down to 27.2% in Q2. Rates stay structurally high, so keep always-on rate content and plan for short cool-offs.

State and Territory Search Differences and Localization Priorities

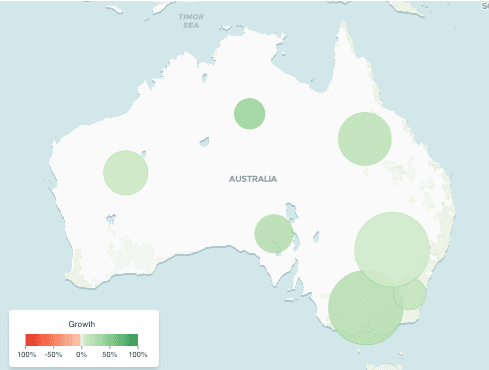

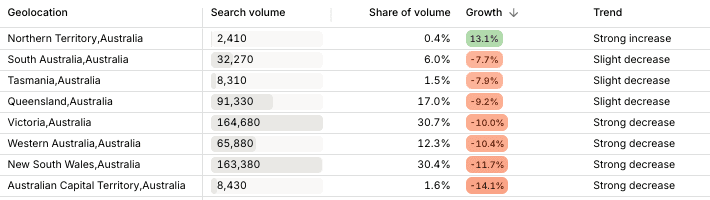

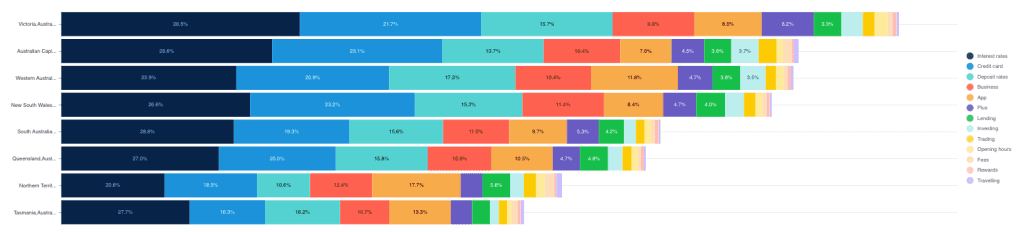

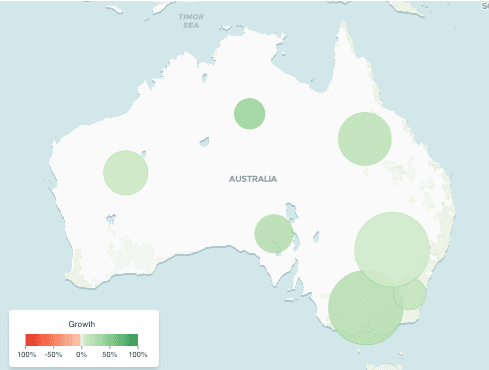

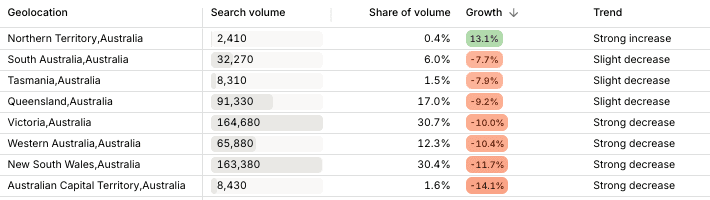

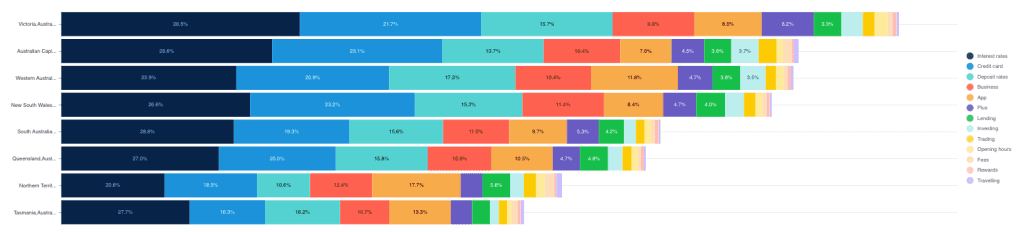

A deeper look at the data reveals significant regional differences in banking priorities. New South Wales, Australian Capital Territory and Victoria are the largest markets, with high search volumes across all major banking topics, particularly "Interest rates" and "Credit cards." Queensland also shows strong interest in these areas, though to a lesser extent.

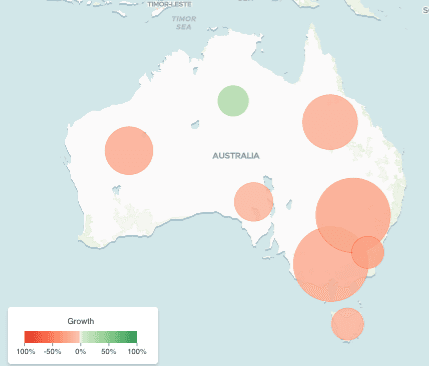

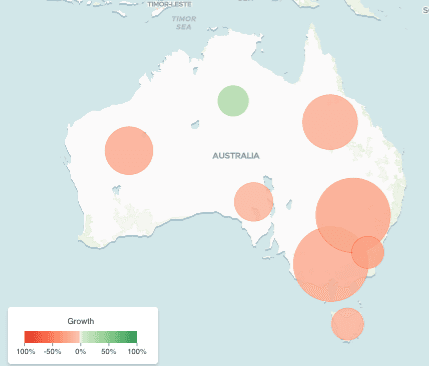

The map below highlights emerging clusters, showing growing interest in "Interest Rates" and "Credit Cards".

In contrast, Northern Territory Australia displays a proportionally higher interest in "Deposit rates" compared to other regions where the topic is decreasing, suggesting a more savings-oriented consumer base.

The map below clearly highlights the interest in "Deposit rates" increasing on that only region compare to other regions of Australia.

Understanding these local nuances is essential for tailoring marketing messages and product offerings to specific regional markets.

Regional Variances in Banking Needs

Northern Territory:

Top interests: App 12.4%, Business 17.7% (highest nationally).

Lowest: Interest rates 20.6%, Deposit rates 10.6%.

Focus: Mobile-first onboarding, business journeys, borrowing tools, and rate-led content.

Tasmania:

Strong: Interest rates 27.7%, Deposit rates 16.2%.

Weakest: Credit card 16.3% (lowest nationally).

Strategy: Use clear rate explainers, savings calculators, and simpler digital paths; card growth will be challenging.

Western Australia:

Leads: Deposit rates 17.2% (highest).

Solid: Business 11.8%.

Softer: Interest rates 23.9%.

Approach: Highlight savings and cash management value, supported by business content.

Victoria:

High: Interest rates 28.5%, Plus 6.2% (highest).

Low: App 9.8%, Lending 3.3% (lowest).

Action: Deliver best-in-class rate content and strong digital banking messaging; improve mobile UX.

New South Wales:

Most card-led market: Credit card 23.2%, App 11.4%, Business 8.4%.

Tactic: Push card comparisons and offers, driving app-based onboarding.

Queensland:

Balanced but mobile-leaning: App 10.9%, Lending 4.8%, Credit card 20.0%.

Plan: Lead with mobile UX, prequalification tools, and flexible borrowing options.

From Interest Rates to Apps: How Brand Leaders Shift by Search Intent

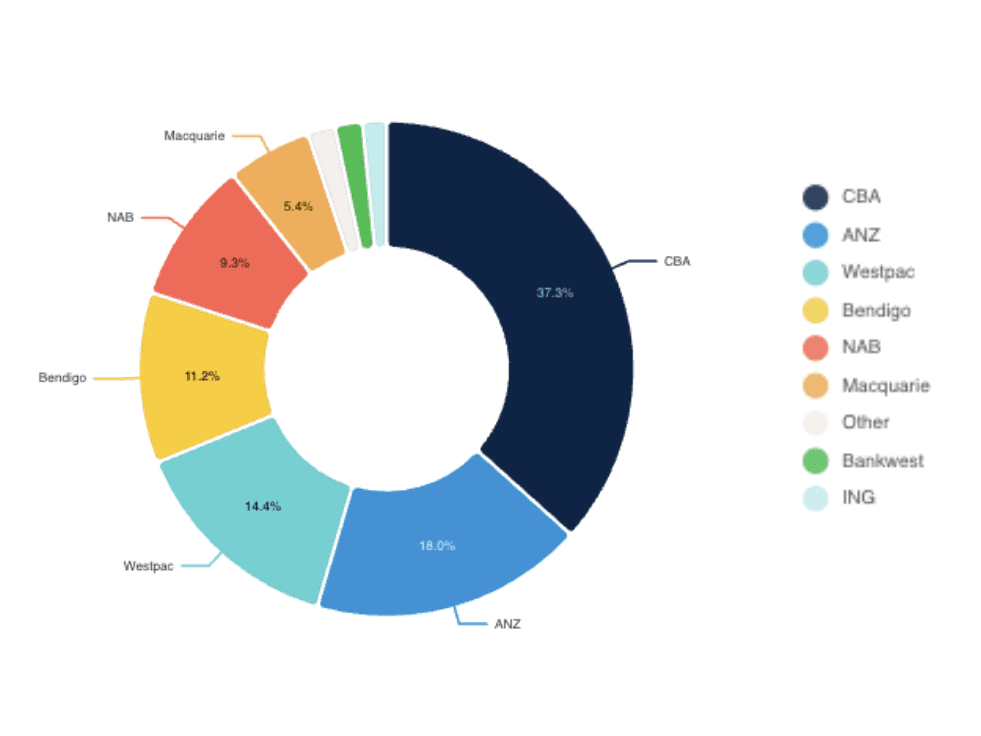

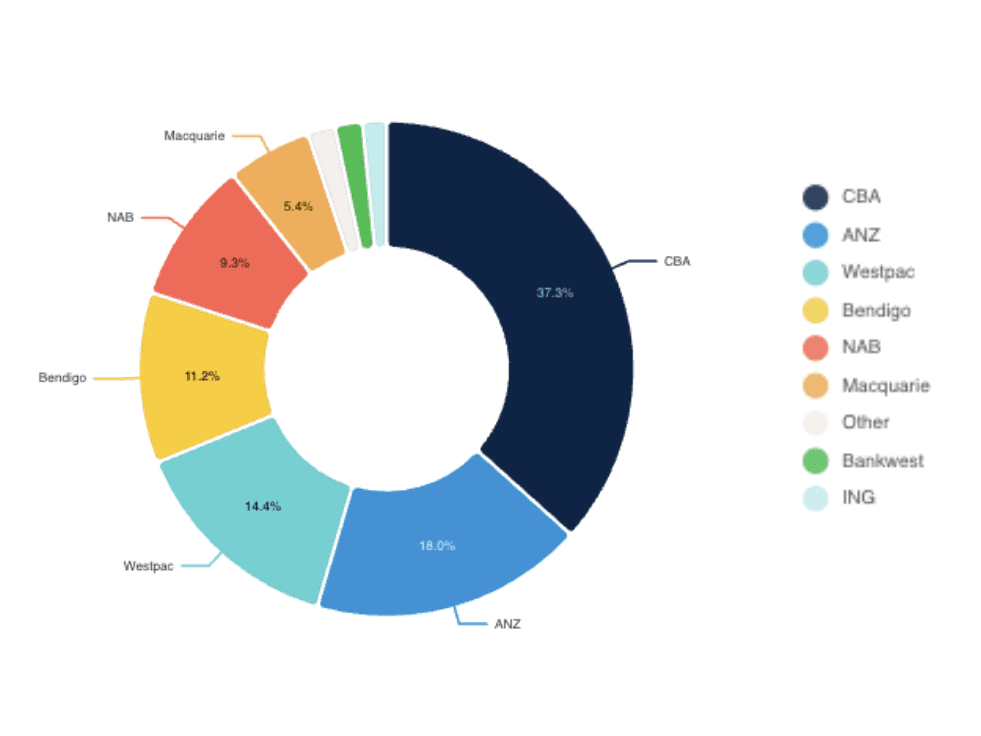

Within the tracked keyword universe, category normalized brand share of search shows CBA leading at 36.4% of labeled volume, followed by ANZ at 18.8%, Westpac at 14.5%. ING is at 1.4%, UP at 1.2%. And Ubank, Revolut and Mebank are under 1%.

Steps to Overtake Today’s Leaders in Australian Banking Search

Focus for H2:

Prioritize Credit cards, the App, and Business banking over last year’s trends.

Keep rate pages fast, accurate, and ready for RBA updates.

State Strategies:

NT & TAS: Mobile-first creative, quick ID checks, and clear in-app help.

WA: Savings calculators and simple “getting started” investing pages.

VIC: Plain-English rate explainers and strong Plus-themed stories.

NSW: Side-by-side card comparisons—fees and rewards made simple.

ACT: Transparent fee tables and easy-to-use calculators.

QLD: Highlight mobile experience and flexible borrowing options.

Compete Where Leaders Excel

Build a live rate hub with structured data and rate history to narrow CBA’s edge.

Launch a card hub with one-click comparisons and prequalification to challenge ANZ.

Create an investing starter path with watchlists, small first trades, and no jargon to chip at Westpac.

Convert App Intent

Platform-specific app pages.

Show uptime or status updates.

Add security FAQs and deep links to key tasks.

Bottom line: Australian banking search is moving from rate talk to action, driven by credit card and app growth. Winning means state-tailored journeys, better app landings, live rate hubs, and simpler investing funnels backed by real-time trend tracking.

Australian banking searches cluster around interest rates, credit cards, deposit rates, and business banking, with app intent and investing emerging as the only clear growth areas while overall rate chatter cools.

To win in this landscape, banks should:

Guide users with beginner-friendly investing paths and weekly share tracking.

Perfect app landing experiences.

Offer sharper credit card comparisons.

Deliver localized content that reflects state-level needs.

Maintain live rate hubs for real-time engagement.

Early Market Signals and How to Respond: Apps and Cards Up, Investing Rebounding, Rate Interest Easing

App resilience is real: after an early-2025 dip, app intent rebounded to 9.8% with rising 3-month momentum. Push app performance, money tools, and login reliability to capture new demand.

Investing bounce has started: investing searches jumped 24% in June (2.7% share). States with high appetite are ready for education and easy entry products.

Credit cards outperformed: share rose 3 pts in June with strong brand demand. Use refreshed offers and reward copy to convert interest. Quarterly share slipped slightly to 21.5% in Q2 (vs 22.1% in Q1, 22.3% in Q4 2024).

Interest Rate increase is visible: peaked at 28.9% in Q1 2025, down to 27.2% in Q2. Rates stay structurally high, so keep always-on rate content and plan for short cool-offs.

State and Territory Search Differences and Localization Priorities

A deeper look at the data reveals significant regional differences in banking priorities. New South Wales, Australian Capital Territory and Victoria are the largest markets, with high search volumes across all major banking topics, particularly "Interest rates" and "Credit cards." Queensland also shows strong interest in these areas, though to a lesser extent.

The map below highlights emerging clusters, showing growing interest in "Interest Rates" and "Credit Cards".

In contrast, Northern Territory Australia displays a proportionally higher interest in "Deposit rates" compared to other regions where the topic is decreasing, suggesting a more savings-oriented consumer base.

The map below clearly highlights the interest in "Deposit rates" increasing on that only region compare to other regions of Australia.

Understanding these local nuances is essential for tailoring marketing messages and product offerings to specific regional markets.

Regional Variances in Banking Needs

Northern Territory:

Top interests: App 12.4%, Business 17.7% (highest nationally).

Lowest: Interest rates 20.6%, Deposit rates 10.6%.

Focus: Mobile-first onboarding, business journeys, borrowing tools, and rate-led content.

Tasmania:

Strong: Interest rates 27.7%, Deposit rates 16.2%.

Weakest: Credit card 16.3% (lowest nationally).

Strategy: Use clear rate explainers, savings calculators, and simpler digital paths; card growth will be challenging.

Western Australia:

Leads: Deposit rates 17.2% (highest).

Solid: Business 11.8%.

Softer: Interest rates 23.9%.

Approach: Highlight savings and cash management value, supported by business content.

Victoria:

High: Interest rates 28.5%, Plus 6.2% (highest).

Low: App 9.8%, Lending 3.3% (lowest).

Action: Deliver best-in-class rate content and strong digital banking messaging; improve mobile UX.

New South Wales:

Most card-led market: Credit card 23.2%, App 11.4%, Business 8.4%.

Tactic: Push card comparisons and offers, driving app-based onboarding.

Queensland:

Balanced but mobile-leaning: App 10.9%, Lending 4.8%, Credit card 20.0%.

Plan: Lead with mobile UX, prequalification tools, and flexible borrowing options.

From Interest Rates to Apps: How Brand Leaders Shift by Search Intent

Within the tracked keyword universe, category normalized brand share of search shows CBA leading at 36.4% of labeled volume, followed by ANZ at 18.8%, Westpac at 14.5%. ING is at 1.4%, UP at 1.2%. And Ubank, Revolut and Mebank are under 1%.

Steps to Overtake Today’s Leaders in Australian Banking Search

Focus for H2:

Prioritize Credit cards, the App, and Business banking over last year’s trends.

Keep rate pages fast, accurate, and ready for RBA updates.

State Strategies:

NT & TAS: Mobile-first creative, quick ID checks, and clear in-app help.

WA: Savings calculators and simple “getting started” investing pages.

VIC: Plain-English rate explainers and strong Plus-themed stories.

NSW: Side-by-side card comparisons—fees and rewards made simple.

ACT: Transparent fee tables and easy-to-use calculators.

QLD: Highlight mobile experience and flexible borrowing options.

Compete Where Leaders Excel

Build a live rate hub with structured data and rate history to narrow CBA’s edge.

Launch a card hub with one-click comparisons and prequalification to challenge ANZ.

Create an investing starter path with watchlists, small first trades, and no jargon to chip at Westpac.

Convert App Intent

Platform-specific app pages.

Show uptime or status updates.

Add security FAQs and deep links to key tasks.

Bottom line: Australian banking search is moving from rate talk to action, driven by credit card and app growth. Winning means state-tailored journeys, better app landings, live rate hubs, and simpler investing funnels backed by real-time trend tracking.

Matthieu Danielou

Co-founder

Share